The 4M Framework

Knowledge is power. But only if you know how to apply it.

The 4M framework is built to simplify stock analysis and make the market easier to understand, helping you build confidence in your financial decisions and long-term goals.

#1 Meaning

Whether you’re still trying to figure out where to start or you’ve been in the market for a while, the stock market can feel like chaos.

This part of the program helps you cut through the noise, so you can see the market clearly and understand what’s really happening beneath the surface.

You’ll learn how to:

- Build your own circle of competence and filter through thousands of stocks to focus only on the few that truly make sense to you.

- Discover why the stock market isn’t just “random numbers on a screen” and finally see the logic behind why prices rise and fall.

- Escape the overwhelm trap and quit the chase for hot tips that always collapse.

- Follow a simple, repeatable process for identifying strong businesses in any market condition and gain the confidence to tune out daily market noise.

- Understand what truly drives long-term business value so you can think like an investor, not a speculator.

#2 MOAT

Most investors drown in numbers they don’t understand. You’ll learn to see what actually matters.

Inside this section, you’ll know how to:

- Decode financial statements – income, balance sheet, and cash flow, so you can see how healthy a business really is (no accounting degree required).

- Leverage AI tools to simplify and speed up analysis without sacrificing accuracy.

- Spot the key ratios that reveal a company’s real strength and earning power.

- Identify what gives a business staying power – the edge that keeps profits strong while competitors fade.

- Understand why some companies skip dividends.

- Explore dividend-paying stocks and uncover why some companies keep growing payouts while others can't keep up.

- See that value and growth investing are connected.

#3 Motivation

Great businesses aren’t just built on numbers – they’re driven by the people behind them.

In this part of the program, you’ll learn how to:

- Instantly view CEO and executive compensation and learn what their pay reveals about a company's true priorities.

- See if management incentives align with long-term value creation or not.

- Spot when leadership teams are “massaging” numbers to look better than reality, and identify early red flags of poor governance or manipulation

- Apply Charlie Munger’s principle: “Show me the incentive, and I’ll show you the outcome”.

#4 Margin

This is where you learn how to think in terms of value, not just price.

You’ll discover how to:

- Build a simple framework for analysing both accounting earnings and real cash flow.

- Understand how discount rates shape valuation models and how to think about them in a way that fits your approach.

- Use the Rule of 72 to see how time and growth interact and the power of compound interest.

- Replace the fear of short-term price swings with a long-term process that keeps you calm, rational, and focused.

- Build confidence knowing your decisions are based on logic, not luck.

WHO THIS PROGRAM IS FOR

If you’ve bounced between “strategies” that promised quick wins but never built real understanding, Retail Investors Hub gives you the structured, long-term approach you’ve been missing.

This isn’t a shortcut – it’s a framework for clarity. It requires patience, reflection, and a willingness to challenge how you currently see the market. If that sounds like you, I’d be honoured to have you inside.

Retail Investors Hub Is Perfect For You If:

- You’re ambitious and want to understand how money can work for you without sacrificing time, wellbeing, or peace of mind.

- You are willing to learn, apply, and take full responsibility for your own decisions.

- You think long-term and are not interested in get-rich quick schemes.

- You understand that all investing carries risk and real progress comes from effort and analysis, not guarantees.

It’s Not For You If:

- You’re looking for stock tips or specific recommendations.

- You want a plug-and-play formula or a magic list of “best stocks”.

- You’re chasing quick money or short-term trading thrills.

- You don’t plan to study the material and just want to copy others – that’s not what this program and community is about.

The Silent Killer

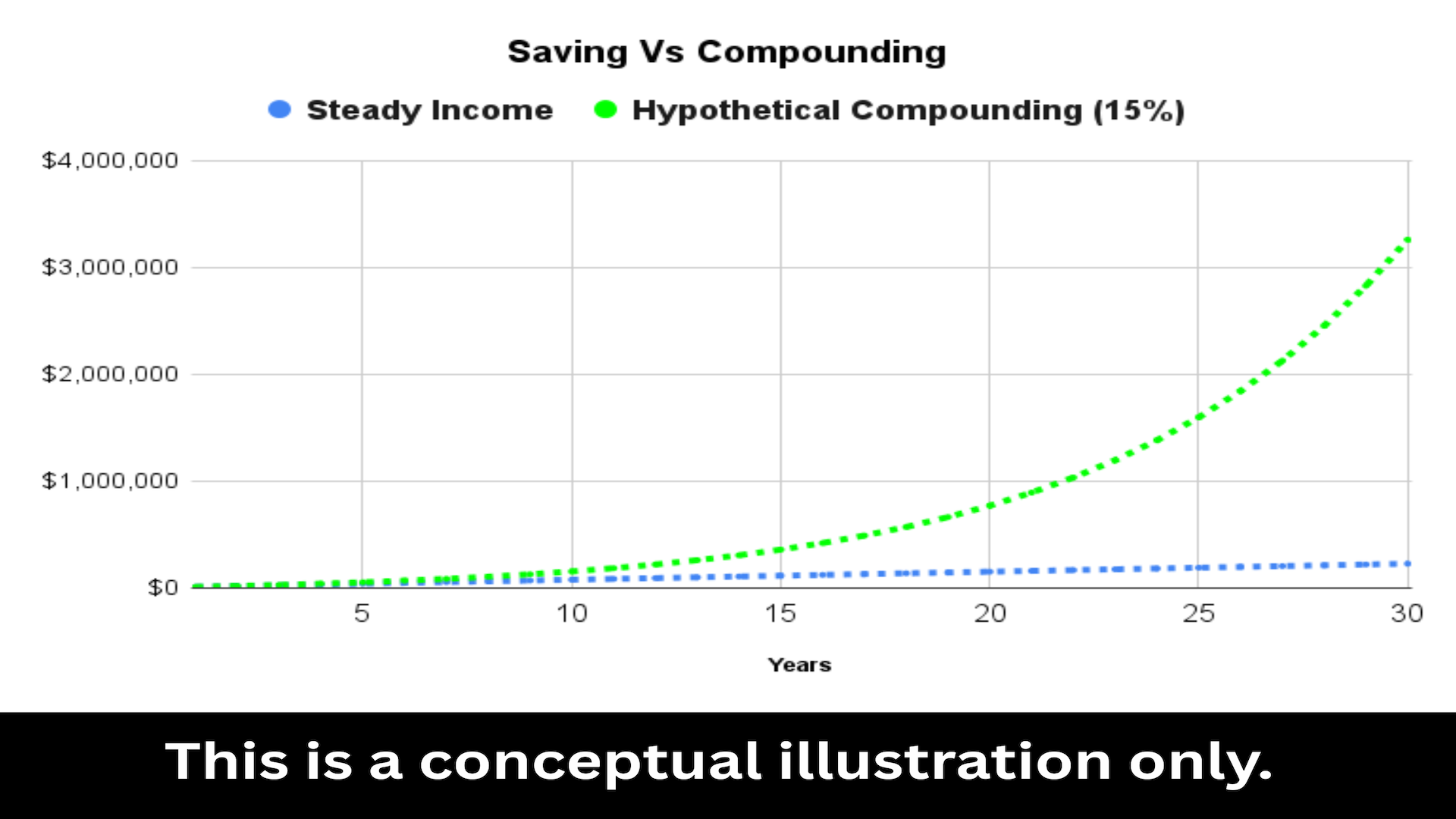

The biggest threat to your financial future isn’t failure. It’s standing still while everything around you compounds.

Money saved is money lost because inflation reduces the value of your savings.

And there is a hard cap on how much money you can earn if your income is tied to your time. And most people hit that ceiling without even realising it.

If your earnings depends on your time, your upside is limited.

But when you build something that grows without your input – that’s where the curve starts to bend.

This is the difference between trading time and building leverage.

Understanding that difference is where financial freedom begins.

HERE’S EVERYTHING YOU GET WHEN YOU JOIN TODAY

We can’t wait for you to experience the combined wisdom this program delivers.

Here’s what it took to build what’s inside.

- 50+ investing books and hundreds of company reports: Over $2,000 invested learning from the world’s best investors.

- 22,000+ pages of reading distilled into clear, practical lessons you can apply in under 10 hours.

- Backed by years of real-world investing and thousands of hours testing what works.

The result of over $28,000 worth of time, learning and experience - condensed into a self-paced program to save you years of trial and error.

AND YOU'LL RECEIVE THIS:

Real World Insight: See the 4M Framework applied to real companies, with new case studies every few weeks.

20 Stock Analysis Case Studies eBook (150+ pages): Deep dives into real companies and what drove their performance.

Financial Calculator Pack: Instantly calculate growth rates, ROIC, key metrics, and DCF Valuations.

Portfolio Tracker Template: Track and compare your portfolio’s performance in one customizable, currency-adjusted sheet.

Weekly Live Q&A Sessions: Get your questions answered in real time – never stay stuck.

Direct Email Support: Personal help whenever you need clarity between sessions.

Community Access: Join a network of like-minded DIY investors who are learning alongside you.

Total Estimated Value: Over $30,000

PUTTING THE VALUE IN PERSPECTIVE

A Bad Trade

$5000+ > $0

Chasing quick wins feels good for a moment. Dopamine hits, profits vanish.

Your Daily Coffee

~$3 a day > $1,094 a year

You get a quick caffeine hit but it won’t teach you a skill that actually stays with you.

Takeout Twice a Week

~$15 per meal > $1,560 a year

You get a good meal but you’ll still be scrolling through Reddit wondering what to do next.

Meanwhile, Retail Investors Hub gives you:

- A clear, logical understanding of stock analysis

- A structured process to separate noise from insight

- The confidence to make informed, long-term decisions about your financial future

- At just $1.63 per day.

Unlike short-lived purchases, the knowledge you gain here strengthens over time. They are practical, repeatable, and ready whenever you need it.

THE COST OF TRYING TO DO IT YOURSELF

If you’re reading this, you’re already taking steps to take control of your financial future.

You’ve probably searched for answers...

YouTube, blogs, reports, online communities.

Everyone seems to know something.

But everyone says something different.

Some tell you to focus on the fundamentals.

Others keep it technical.

Some say stick with stocks.

Others say split between stocks and bonds.

But which stocks...?

Growth stocks?

Value stocks?

Small cap?

Large cap?

And what about diversification...

How much diversification is enough?

Should you just DCA into an index and hope for the best?

And then you start hearing about market crashes and interest rates.

Just hold cash and wait to "buy the dip".

Others tell you to invest now because timing the market is absurd.

And somewhere between all that noise, the idea of investing starts to feel impossible.

Maybe you’ve spoken to a financial adviser.

Only to realise they overcharge and underdeliver.

It’s no wonder most people give up before they start.

But here’s the truth that no one wants you to know.

Stocks aren’t complicated but the investment industry doesn’t want you to know that.

Most people stare at ticker symbols, without realising that…

A stock is simply a slice of a living business.

When that business grows, your slice grows.

When it stumbles, so does the stock.

It’s that simple.

If you’ve realised this, you probably have…

Turned to books. Read one on valuation.

Another on accounting, another on “how to invest."

And another on “investor psychology”.

Every piece helps a little, but none of it connects into one clear process.

That’s why I built The 4M Framework.

To bring everything together.

So you can stop chasing disconnected information.

And finally learn the process to stock analysis and understand the market for yourself.

The "Help George Sleep At Night" Money-Back Guarantee

I overthink everything, especially when someone joins my program and doesn’t love it.

The idea of someone walking away disappointed actually keeps me up at night (and I value my sleep almost as much as a good balance sheet)

So here’s the deal:

If you join Retail Investors Hub and, within the first 14 days or before completing 15% of the program, decide it’s not for you - just email us.

Tell us what didn’t work or what could’ve made it better, and we’ll give you a full refund.

No awkward back-and-forth. No hoops to jump through.

And yes, that one question (“What could we improve?”) isn’t to make things hard; it’s to get your feedback so I can keep making the program better, which helps me sleep better too.

A Final Thought

If you’re reading this far, you already care about doing things the right way.

In meeting thousands of investors (and through my own experience), I’ve noticed something consistent: people rarely regret trying something new that didn’t work out. What they regret is waiting too long to change what clearly wasn’t working.

Time is the one thing we don’t get back. Without a clear direction, it’s easy to let weeks, months, or even years drift by - time spent on bad information and calling it “research”.

Even worse, I’ve seen plenty of people get blindsided by short-term success and bad strategy, confusing skill with luck, and paying for it later down the road.

Whether or not you decide to join the Retail Investors Hub, I hope you take a step toward learning from solid approaches and principles that work. You’ll thank yourself later for doing the work to understand it properly.

But if what you’ve read here feels aligned with how you want to approach the market – logically, patiently, and confidently – then I’d be honoured to help you take that next step.